When dealing with international financial transactions, understanding exchange rates cimb sgd to myr is crucial. One commonly discussed conversion is the exchange rate between the Singapore Dollar (SGD) and the Malaysian Ringgit (MYR). This article delves into the intricacies of the CIMB SGD to MYR exchange rate, exploring various facets including historical trends, economic factors, impacts on businesses and individuals, and tips for getting the best rates.

1. Historical Trends in the CIMB SGD to MYR Exchange Rate

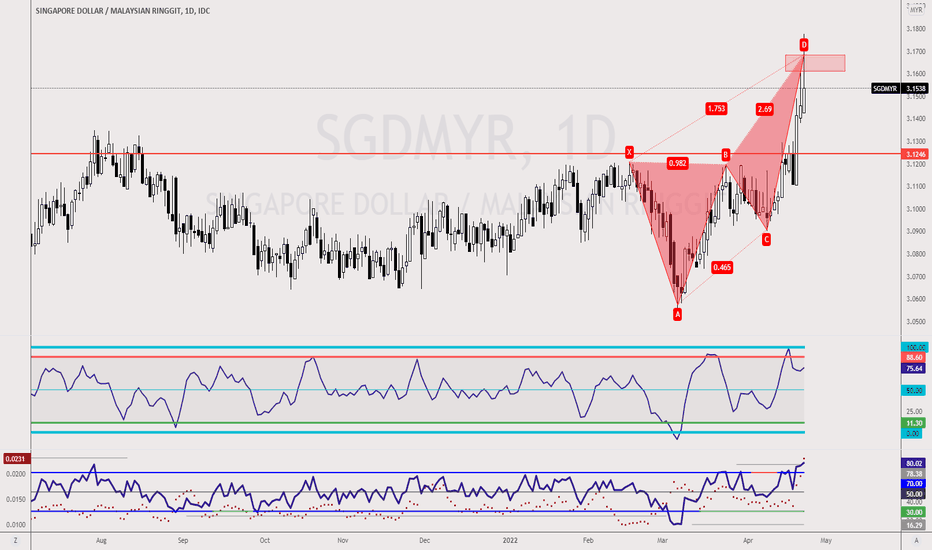

The exchange rate between SGD and MYR has fluctuated significantly over the years, influenced by a myriad of economic, political, and social factors. To understand the current scenario, it is essential to look at historical trends.

Historically, the SGD has been relatively strong compared to the MYR. Several reasons contribute to this trend. Firstly, Singapore’s robust and diverse economy plays a significant role. The country has a high GDP per capita, strong governmental policies, and a stable political environment, which instills confidence in its currency. In contrast, Malaysia, while also having a growing economy, faces more volatility due to its dependency on commodity exports like oil and palm oil, which are subject to global price swings.

Over the past decade, there have been periods where the SGD strengthened significantly against the MYR, particularly during times of economic uncertainty. For instance, during the global financial crisis of 2008 and the more recent COVID-19 pandemic, the SGD appreciated against the MYR as investors sought safer havens for their money.

Additionally, changes in monetary policies by central banks, such as interest rate adjustments, can also impact the exchange rate. For example, if the Monetary Authority of Singapore (MAS) decides to tighten monetary policy to curb inflation, it could strengthen the SGD against the MYR. Conversely, if Bank Negara Malaysia (BNM) lowers interest rates to stimulate the economy, it could weaken the MYR against the SGD.

2. Economic Factors Affecting the CIMB SGD to MYR Exchange Rate

Several economic factors influence the exchange rate between SGD and MYR. Understanding these can help individuals and businesses make informed decisions when dealing with currency exchange.

1. Inflation Rates: Inflation differentials between Singapore and Malaysia play a crucial role. Generally, a country with lower inflation will see its currency appreciate against one with higher inflation. Singapore’s effective control over inflation has often kept the SGD stronger than the MYR.

2. Interest Rates: Interest rate differentials are another critical factor. Higher interest rates in Singapore attract foreign capital, boosting demand for SGD. Conversely, lower interest rates in Malaysia might deter investors, reducing demand for MYR and thus its value.

3. Trade Balances: Both countries’ trade balances impact their currencies. Singapore, with its strong export-oriented economy and significant trade surplus, typically sees a stronger SGD. Malaysia’s trade balance, influenced heavily by commodity prices, can be more volatile.

4. Foreign Exchange Reserves: The reserves held by the central banks of both countries can influence the exchange rate. Larger reserves can stabilize a currency and instill confidence among investors.

5. Economic Growth: The economic growth rates of both countries also matter. Strong economic performance in Singapore relative to Malaysia can lead to SGD appreciation.

Understanding these economic factors provides a clearer picture of the dynamics at play in the CIMB SGD to MYR exchange rate.

3. Impact on Businesses and Trade

The exchange rate between SGD and MYR significantly impacts businesses engaged in trade and investment between Singapore and Malaysia. Here’s how it affects different sectors:

1. Exporters and Importers: For Malaysian exporters, a weaker MYR is advantageous as their goods become cheaper for foreign buyers, boosting competitiveness. Conversely, Singaporean importers benefit from a stronger SGD, as they can purchase Malaysian goods at a lower cost.

2. Tourism and Hospitality: The tourism industry in both countries is affected by exchange rate fluctuations. A stronger SGD makes Singapore a more expensive destination for Malaysians, potentially reducing tourist inflows. On the other hand, a weaker MYR makes Malaysia more attractive to Singaporean tourists, boosting their tourism revenue.

3. Real Estate: In the real estate market, a stronger SGD gives Singaporean investors more purchasing power in Malaysia. This can lead to increased investments in Malaysian properties, driving up prices in popular areas.

4. Investment and Financial Services: Exchange rates also impact cross-border investments. A strong SGD can lead to increased investment in Malaysia, as Singaporean investors seek to take advantage of the favorable exchange rate. Financial services companies, including banks like CIMB, play a crucial role in facilitating these transactions.

Overall, the exchange rate has a ripple effect across various sectors, influencing trade balances, investment flows, and economic relations between Singapore and Malaysia.

4. Impact on Individuals and Personal Finance

For individuals, the CIMB SGD to MYR exchange rate can have significant implications on personal finances, especially for those involved in cross-border activities. Here are some key areas affected:

1. Remittances: For Malaysians working in Singapore, a strong SGD means higher remittance value when sending money back home. This can greatly benefit their families in Malaysia, enhancing their purchasing power.

2. Education: Many Malaysians study in Singapore, and fluctuations in the exchange rate can impact the cost of education. A weaker MYR against the SGD means higher tuition fees and living expenses for Malaysian students.

3. Travel and Leisure: For travelers, the exchange rate determines how far their money goes. A strong SGD makes traveling to Malaysia more affordable for Singaporeans, while a weaker MYR means Malaysians need to spend more when visiting Singapore.

4. Investments: Individuals looking to invest in foreign assets are also affected. Singaporeans can take advantage of a strong SGD to invest in Malaysian assets, potentially yielding higher returns.

5. Savings and Expenditure: Exchange rate fluctuations can impact savings and expenditure for those holding accounts in both currencies. Monitoring these changes can help individuals make strategic financial decisions.

Understanding the exchange rate helps individuals manage their finances more effectively, whether it’s for savings, investments, or daily expenditures.

5. Tips for Getting the Best CIMB SGD to MYR Exchange Rates

To maximize the value of currency exchanges, here are some tips for getting the best CIMB SGD to MYR exchange rates:

1. Monitor the Market: Keep an eye on the exchange rate trends and economic news. This can help you time your transactions to when the rates are most favorable.

2. Use Online Tools: Utilize online currency converters and financial platforms to compare rates offered by different banks and money changers.

3. Avoid Peak Times: Exchange rates can be less favorable during peak travel seasons and holidays. Plan your exchanges during off-peak times to get better rates.

4. Consider Forward Contracts: For businesses and individuals dealing with large sums, forward contracts can lock in current exchange rates for future transactions, protecting against unfavorable rate movements.

5. Use Multi-Currency Accounts: Banks like CIMB offer multi-currency accounts that allow you to hold and manage funds in different currencies, minimizing the need for frequent exchanges.

6. Negotiate Rates: For large transactions, don’t hesitate to negotiate rates with your bank or money changer. Sometimes, you can get a better deal by asking.

By following these tips, you can ensure that you get the most value out of your currency exchanges, whether for personal or business purposes.